Baby Boomers are set to pass an unprecedented amount of wealth to the next generation in the form of businesses and personal assets. Yet, most family wealth is earned—and then lost—over the course of three generations,1 so planning for this wealth transfer is crucial to preserving financial wellbeing.

-

Instilling philanthropy in the next generation

Instilling philanthropy in the next generationMany families focus on succession planning as a way to ensure the health and legacy of their family business. As you prepare for the future, incorporating philanthropy can also provide valuable lessons regarding your family's values and management of its wealth. "When philanthropy becomes a family conversation it can then bleed over into the bigger conversation of being thoughtful and careful about money in general," says Jayne Hartley, Senior Wealth Strategist at The Private Bank at Union Bank. "Once heirs are financially confident in the charitable sphere, it often translates to financial confidence in the rest of their lives."

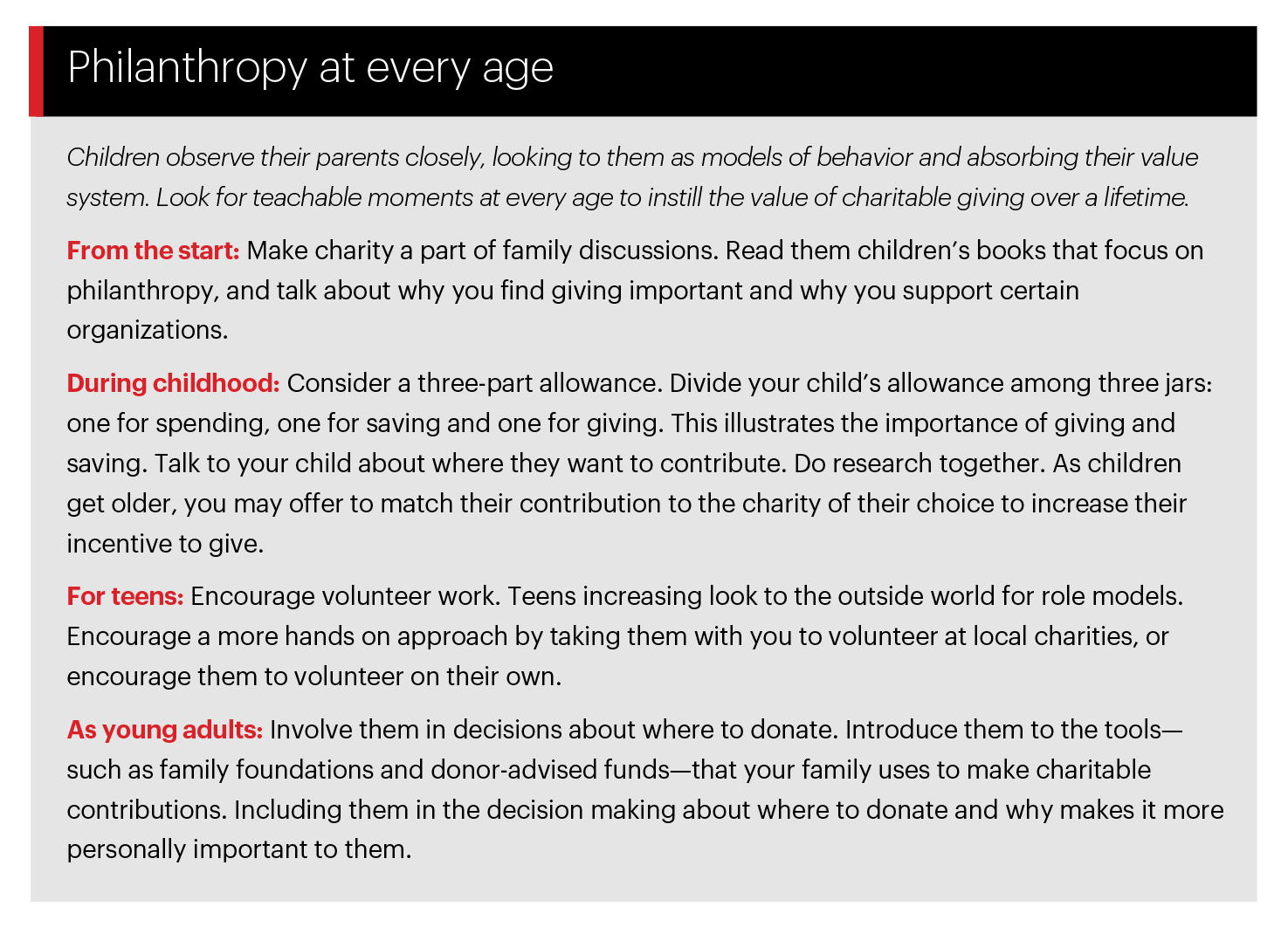

Educating your children and grandchildren about charitable giving offers opportunities to teach financial lessons, in addition to giving heirs a sense of ownership and responsibility over the family’s assets. The good news is that these next generations are interested and already involved in giving. In 2014, 84% of Millennials made a charitable donation, and 70% spent time volunteering.2 The key to integrating that interest with your family's legacy is including them in your family's philanthropic pursuits as early as possible, and establishing a plan that encourages giving over the long term.

Involve your younger generation early, and you'll help ensure that a legacy of giving transfers along with your assets.

-

Upcoming generations primed for giving

Upcoming generations primed for givingWhen it comes to charitable giving, Millennials, born roughly between 1980 and 1996, and Generation Z, born after the Millennials, exhibit traits that differ from older generations. For example, Baby Boomers, who donate 43% of all dollars given to charity, tend to spread the money they give among four to five charities each year.3 The causes they give to are likely to include social services, religious organizations, veterans' services, and colleges. Comparatively, while Millennials are also philanthropically inclined, the causes they give to differ from their parents and grandparents.

Millennials are interested in purpose-driven giving to specific, vivid causes. They want to feel inspired by the organization and see the impact of their giving. Millennials prefer charities that do work in education, health care and environmental causes.5 They are also less interested in the religious organizations and colleges their parents gave to, and they are less likely to prefer making gifts through their places of work.

Members of Generation Z, born in the mid-90s to early '00s, are still in their teenage years, so many are not yet earning money of their own. As the first generation to grow up entirely with the Internet they will likely harness online platforms, such as crowd funding, to make a difference. Because of their unique experiences, you may want to approach how you include younger heirs in ways that vary from prior generations.

-

5 steps for engaging the next generation

5 steps for engaging the next generationAccording to Hartley, younger generations will need you to get them involved in family giving and you can help lay the groundwork for that involvement with the following specific strategies:

-

Document your family's philanthropic history

You want to make sure younger generations understand your family's legacy of giving and how and why your family gives to charity. This is particularly important in situations such as family foundations where the youngest generation may not have had the opportunity to personally know the founding generation.

-

Create a mission and values statement

Many businesses already make use of mission statements, and the practice is beginning to catch on in families to support their charitable giving. Work together to define your family's mission, or the reasons your family gives. Use this statement to outline your family's values, the principles and behaviors that guide your philanthropy. Make the statements direct and personal so that they can be clearly understood and are meaningful to the family. You may wish to include a record of the origins of the family’s charitable pursuits, including its funding, to give your family mission context and historical perspective.

Developing a mission is a great way to engage younger generations. Building a mission statement together helps create family unity by sharing commitment to philanthropic objectives across generations.

-

Include heirs in the philanthropic work

Hartley recommends that you encourage the next generation's involvement by including them in your family's decisions about where to make donations. This can help the younger members feel more personally connected to the gifting.

If you already have a family foundation with a formal board, it may make sense to have young members of the family join the board when they reach college age or become young professionals. Pair new board members with more experienced members who can help teach about the foundation and its work. Not only does this provide younger family members with a strong understanding of financial basics, but it's also an opportunity for older generations to see how the heirs manage the family finances.

-

Set aside a portion of assets that younger generations can direct to charities themselves

"Challenge your children to define what they think their cause is, then encourage them to research the charities they are interested in and find how each organization uses the money they receive," Hartley says. Websites such as Guidestar.org and Charitynavigator.org allow users to compare charities based on governance, overhead and the percentage of donations that goes to the cause. After each family member researches their organization of choice, they can come together to discuss what they've learned and whether to make the gift.

-

Make these meetings a regular part of family life

Include Millennial and Generation Z family members, and remember that older generations should be careful to be open to the differing goals younger generations may bring to the table.

-

Document your family's philanthropic history

-

Gifting via family foundations

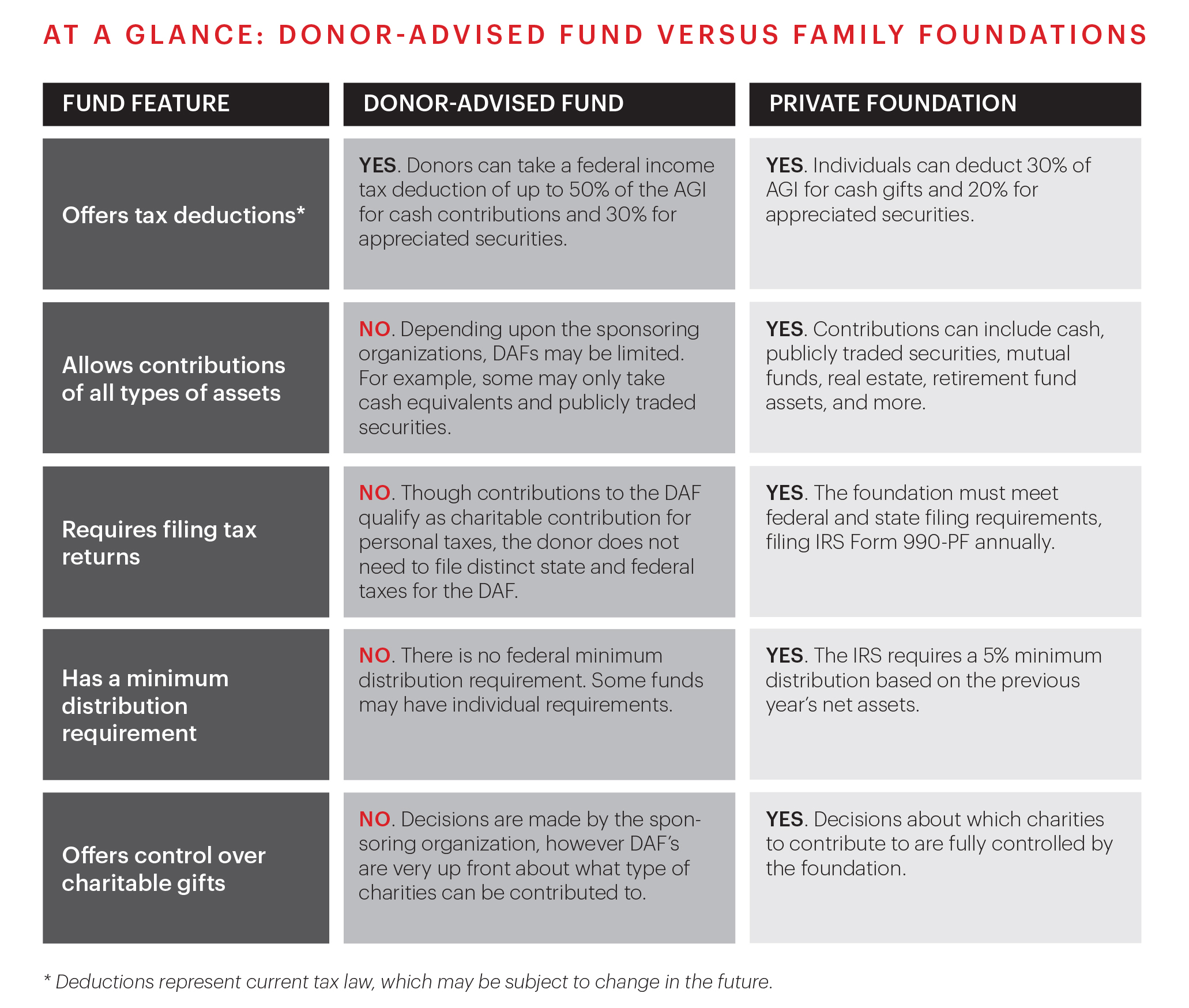

Gifting via family foundationsThere are a number of ways that you can make donations, including donating assets directly to charitable organizations. But for families looking for formal tools, family foundations and donor-advised funds can help organize your giving.

Typically, family foundations receive primary funding from an individual or family, and they provide for targeted giving that falls in line with your family’s philanthropic mission statement. These financial vehicles allow your family to pursue charitable goals in a tax-efficient way, while offering additional benefits.

For example, gifts to the foundations from family members and others are tax-deductible, and no capital gains are realized when donors give appreciated securities that are traded on an established stock exchange such as the NYSE or NASDAQ. You can claim a deduction on the full market value of these donated publicly traded appreciated stocks as long as you and your family do not contribute 10% or more of your current ownership position. Only stocks are deductible at fair market value, while gifts of appreciated property are deductible on a cost basis.

Foundations offer additional benefits as well. The income sheltered within the foundation is tax exempt, and it is not subject to estate taxes, which is why many families consider foundations during their estate planning process. Investments held by the foundation offer continued tax-exempt growth that you can direct toward charity. Private foundations also make it easy for your family to give consistently. For example, the Internal Revenue Service (IRS) requires that foundations distribute at least 5% of their net investment assets annually in the form of charitable donations or certain qualified expenses.

Though family foundations offer many benefits, there are a few drawbacks, Hartley notes. First, they can be time consuming and costly to set up. For these reasons, though there is no rule about how much you need to contribute to initially fund a family foundation, you will likely want to begin with a considerable sum, or at least plan to get up to this amount in a few years. “Many experts recommend starting with as much as $3 million,” says Hartley.

And while the foundation assets are not subject to income taxes, they are subject to excise tax of 1-2% on net investment income depending on the foundation’s level of grant making. The tax deductions available to you through your family foundation are lower than if you were to make a gift to a public charity. Currently, individuals can only deduct 30% of Adjusted Gross Income (AGI) for cash gifts and 20% for appreciated property. These figures may vary if tax law changes.

Recordkeeping requirements may also be time consuming, and something that your family should consider when setting up a family foundation. For example, all grants must be properly documented and reported to the IRS.

-

Donor-advised funds offer an alternative

Donor-advised funds offer an alternativeDonor-advised funds (DAFs) offer a simpler, more convenient option for gifting. These philanthropic vehicles allow you to make a contribution to a single donor-advised fund in exchange for an immediate tax deduction. Once you make the contribution, you can then take your time as to how and where you want to donate your funds. Donor-advised funds are generally easy to use, cost effective and tax efficient.

One of the main benefits of DAFs is that they require few administrative responsibilities on your part, Hartley says. The funds are managed by a sponsoring organization, which takes investment decisions and regulatory responsibilities out of the hands of donors. Many sponsoring organizations allow grant making through a web portal, which automatically provides detailed reporting and record keeping. Also DAFs can offer you privacy: As a donor, you control how much information is given to grantees, and therefore can remain completely anonymous to the organizations you’re supporting.

Once you put funds in DAF, it doesn’t mean you've automatically donated the money to charity. Remember to take the extra step to recommend grants from your DAF to make sure your money makes it to the charity of your choice.

The popularity of DAFs has been growing in recent years, especially among younger generations. For instance, contributions to these funds increased 11.9% to $78.64 billion in 2015 over the prior year. The number of DAFs grew by 11.1% from 2014 to 2015, compared to 2.6% growth in private foundations over the same period.6 In addition, Millennials recommended more grant dollars to charities from donor-advised funds than their older counterparts, suggesting that these vehicles may be a particularly good way to involve the next generation in philanthropy.7 Millennials recommended just over $9,000 in grant money from DAFs compared to the $7,877 in grants recommended by Baby Boomers.8

However, even as donations to DAFs have grown, some charitable organizations have seen the number of direct donations lag. That's because the money is not necessarily distributed to charity in a timely fashion, and instead sits in the funds awaiting donor recommendations.

The onus is on the donor to remember to make distributions, otherwise the money may just languish in your family's DAF, instead of being put to use in the way your family intended. Another important point: Though donors may make recommendations about grants, the sponsoring organization has strong say about which grants are made. For example, some DAFs may not be able to donate money to causes overseas. So before choosing a DAF, you need to understand the extent to which the sponsoring organization can adhere to your requests for donations.

Additionally, take the time to understand minimum contributions and account balance requirements as well as the fees and payment schedules associated with each DAF. Then choose the one that works best for you.

Talking about money with family members can often feel like a taboo subject. Yet working together on charitable giving can instill family values in the next generation and provide an introduction into a greater conversation about family wealth. A financial adviser can help you and your family understand the best way to carry out your philanthropic goals and understand the best tools for you to use.

"These discussions are about creating a platform for your family to communicate with you and eventually others about the charitable and financial choices they are making," says Hartley.

-

Your Financial Partner for Life

Your Financial Partner for LifeWhether you’re the steward of family assets or want to protect the wealth you worked hard to build, The Private Bank can help. We are dedicated to helping our clients fulfill the ambitions they have for their wealth so they can focus on living more fulfilling lives. Drawing on a tradition of excellence, personalized service, discretion and respected investment experience, our teams offer specialized financial services to meet all of your needs — including banking and investment management services,* specialty asset management, and trust administration services — no matter how complex.